This method records both invoices and bills even if they haven’t been paid yet. This is a highly recommended method because it tells the company’s financial status based on known incoming and outgoing funds. Because the funds are accounted for in the bookkeeping, you use the data to determine growth.

Why Bookkeeping Is Important for Small Businesses

Most individuals who balance their check-book each month are using such a system, and most personal-finance software follows this approach. Transactions include purchases, sales, receipts and payments by an individual person, organization or corporation. There are several standard methods of bookkeeping, including the single-entry and double-entry bookkeeping systems. While these may be viewed as “real” bookkeeping, any process for recording financial transactions is a bookkeeping process.

- It perhaps makes you think of a charles dickens novel set in early victorian england, with rows of clerks perched on high stools writing in large books.

- Assets and liabilities (like inventory, equipment and loans) are tracked separately.

- In the normal course of business, a document is produced each time a transaction occurs.

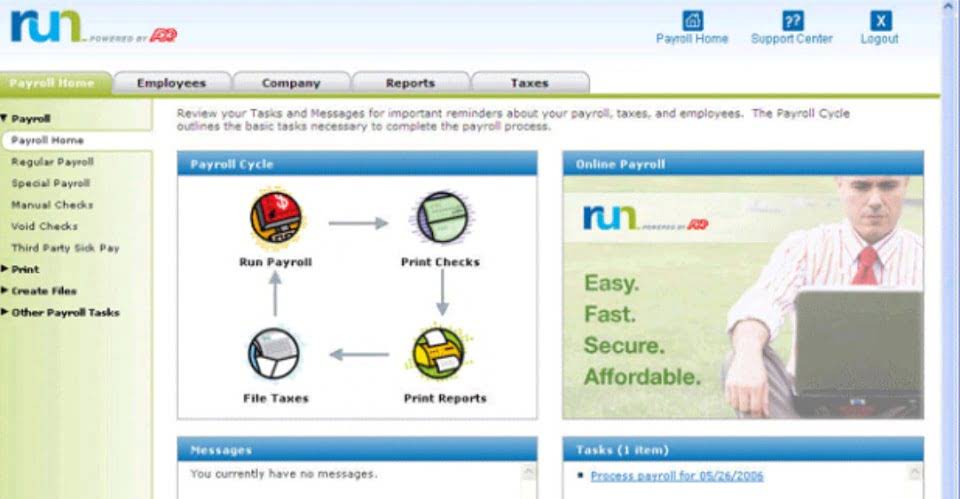

- The service you decide to use depends on the needs of your business and may include extra features such as payroll or tax documents.

Bookkeeping makes your finances clear

For example, your bookkeeper will need to make sure that every transaction in your business’s financial records has an entry. This could range from paying employees or purchasing supplies for your office. A small business can likely do all its own bookkeeping using accounting software. Many of the operations are automated in the software, making it easy to get accurate debits and credits entered. When an effective bookkeeping system is in place, businesses have the knowledge and information that allows them to make the best financial decisions. Tasks, such as establishing a budget, planning for the next fiscal year and preparing for tax time, are easier when financial records are accurate.

- Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

- Online bookkeeping services might be the exact solution you need to save both time and money.

- This information allows you to make smart decisions for future growth and planning.

- You can earn either certification by passing a four-part multiple-choice exam, agreeing to abide by a professional code of conduct, and verifying your bookkeeping accounting education and experience.

- The bookkeeper brings the books to the trial balance stage, from which an accountant may prepare financial reports for the organisation, such as the income statement and balance sheet.

The Accrual vs Cash Basis of Accounting

It’s the meticulous art of recording financial transactions that a business makes. And it gets you on the path to transforming your business into a money-maker. If your company is larger and more complex, you need to set up a double-entry bookkeeping services in sacramento bookkeeping system. At least one debit is made to one account, and at least one credit is made to another account. You also have to decide, as a new business owner, if you are going to use single-entry or double-entry bookkeeping.

Qualifications for Accountants

By adhering to bookkeeping best practices, you can put your business on stronger footing both today and in the future. Business News Daily provides resources, advice and product reviews to drive business growth. Our mission is to equip business owners with the knowledge and confidence to make informed decisions. As part of that, we recommend products and services for their success.

The income statement

- The expected job decline is primarily due to cloud computing and other software innovations automating bookkeeping tasks that a person would normally do.

- Either way, it’s critical to have an accurate balance sheet and income statements.

- Effective bookkeeping requires an understanding of the firm’s basic accounts.

- Xero is working with Australian-founded Mentorloop to bring the Mentor Match initiative to life.

- In fact, actuaries may work for any company or government agency that needs to analyze risk.

- And fittingly, there are two entries in the history books for who documented the double-entry system.

The second organization, the Casualty Actuarial Society (CAS), specializes in certifying actuaries for property and casualty risk for businesses and governments. A treasurer for a large corporation can earn close to $300,000 a year, while other accountants can earn less than $60,000. The median pay for an accountant was $79,880 in 2023, according to the U.S.

Both the CPB and CB certifications require similar eligibility requirements. You can earn either certification by passing a four-part multiple-choice exam, agreeing to abide by a professional code of conduct, and verifying your bookkeeping accounting education and experience. Find out more on bookkeeping accounting skills, how to earn accounting degrees and bookkeeping certifications, getting jobs, salary expectations, and more. All businesses, without exception, need to keep accurate and readily accessible records of their financial transactions. This is an important question that deserves a basic but important answer.

Bookkeeping vs. Accounting

![]()

The two key reports that bookkeepers provide are the balance sheet and the income statement. Both reports should be easy to understand so that all readers can grasp how well the business is doing. In these programs, you can learn accounting principles, accounting software, payroll, how to prepare financial statements, and more.

Bookkeeping is an essential part of your accounting process for a few reasons. When you keep transaction records updated, you can generate accurate financial reports that help measure business performance. Both accountants and bookkeepers maintain accurate financial records, and sometimes, the terms are used interchangeably. Bookkeepers generally focus on administrative tasks, such as completing payroll and recording incoming and outgoing finances. Accountants help businesses understand the bigger picture of their financial situation.